Forces both locally and in international markets have clearly been pushing the Phillips curve down, producing lower inflation. Photo / 123RF

题图:本地和国际市场的力量显然一直在推动菲利普斯曲线下降,从而降低了通胀。图片 / 123RF

Economists working on macroeconomic policy – things like taxes and spending, interest rates, and border controls on flows of trade and money – often refer to a set of key relationships governments can influence.

【澳纽网编译】研究宏观经济政策(如税收和支出、利率以及贸易和资金流动的边境控制)的经济学家经常提到政府可以影响的一系列关键关系。

In the textbooks, each of those relationships is drawn as a curve in a graph.

在教科书中,这些关系中的每一个都绘制为图形中的曲线。

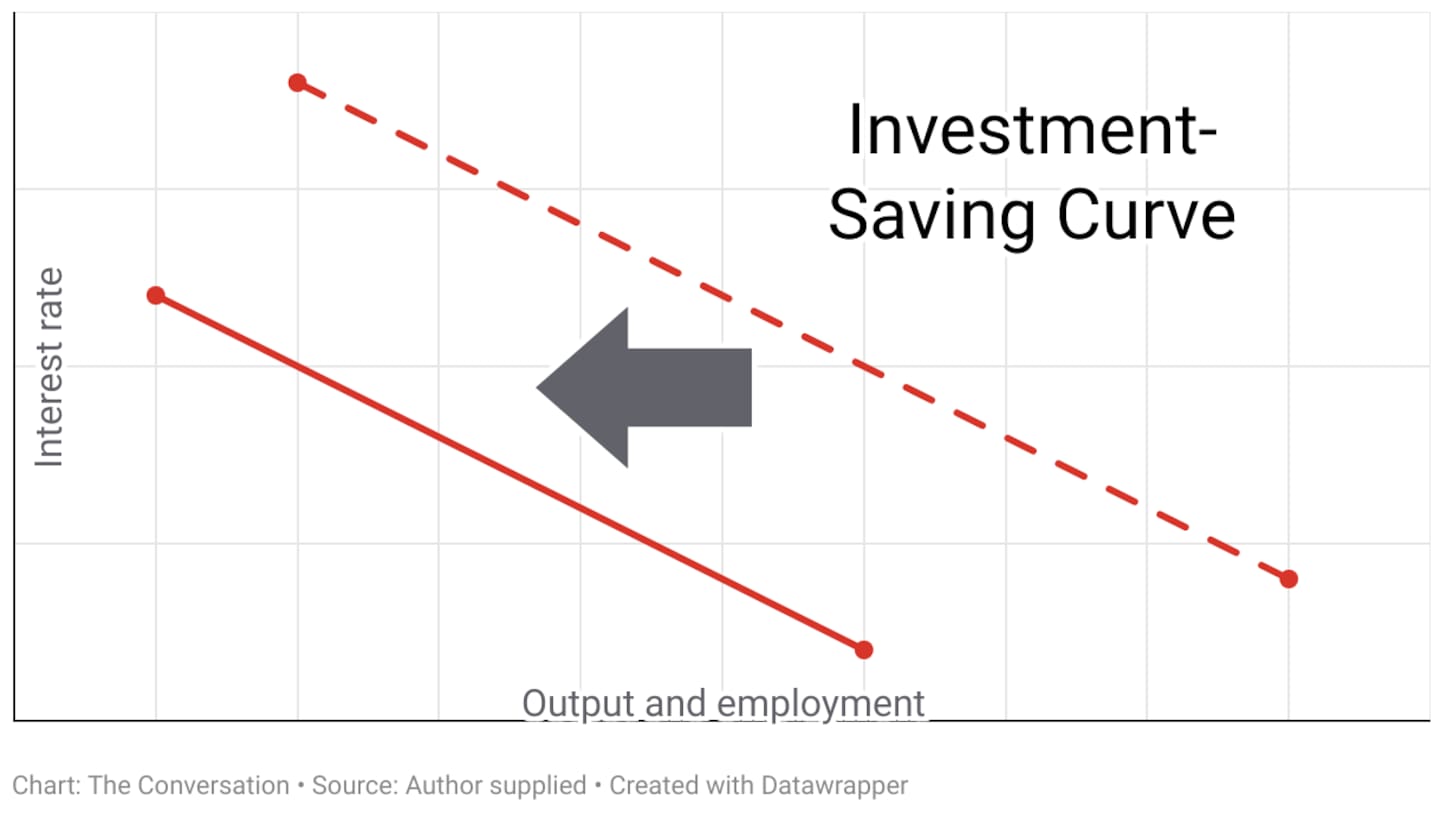

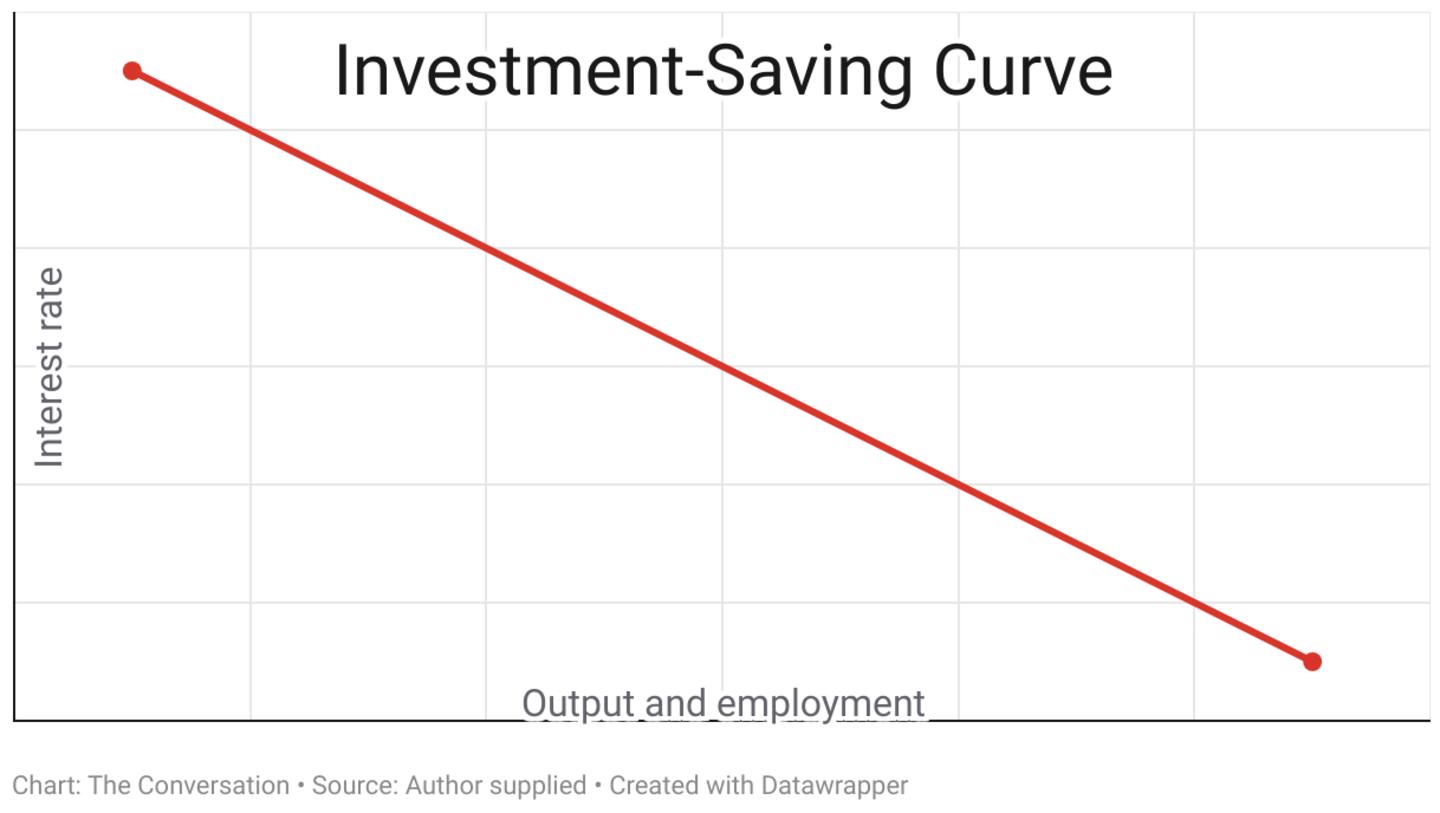

First is the IS (“investment–saving”) curve. This says that if everything else stays the same, the Reserve Bank can increase economic output and employment by lowering the interest rate. Or it can cause a recession by raising the interest rate. (For simplicity’s sake, the curves here are depicted as straight lines.)

首先是 IS(“投资-储蓄”)曲线。这表明,如果其他一切都保持不变,储备银行可以通过降低利率来增加经济产出和就业。或者它可以通过提高利率导致经济衰退。(为简单起见,这里的曲线被描绘成直线。

[xyz-ihs snippet=”In-article-ads”]

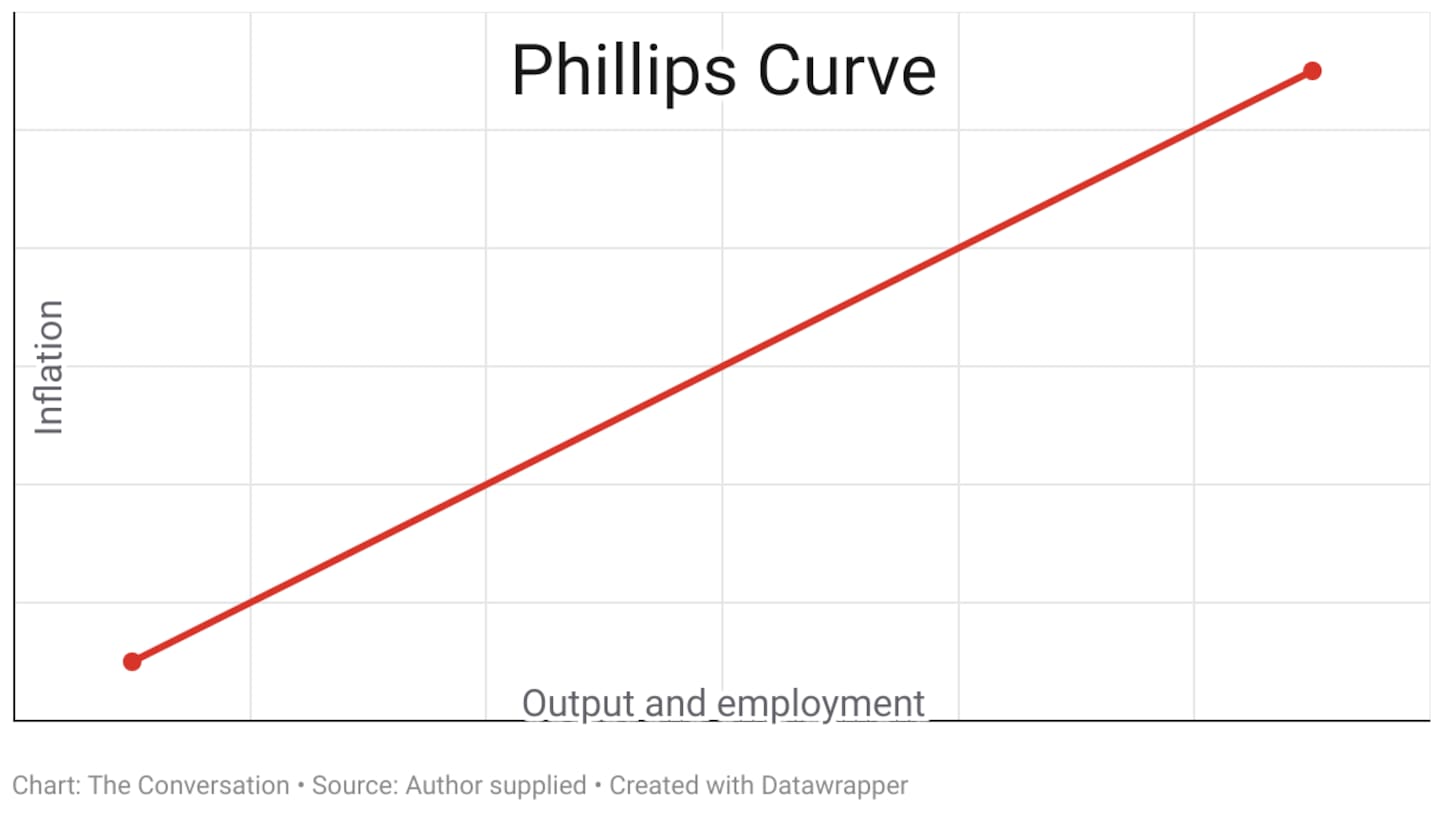

Second comes the Phillips curve, which is usually drawn sloping upwards to suggest that if everything else stays the same, inflation will rise during economic booms and fall in recessions.

其次是菲利普斯曲线,它通常向上倾斜绘制,以表明如果其他一切都保持不变,通货膨胀将在经济繁荣期间上升,在经济衰退期间下降。

[xyz-ihs snippet=”GoogleADresponsive”]

In other words, the Reserve Bank or the government (of the day) can apparently bring inflation down by causing a recession.

换句话说,储备银行或(当时的)政府显然可以通过引发经济衰退来降低通货膨胀。

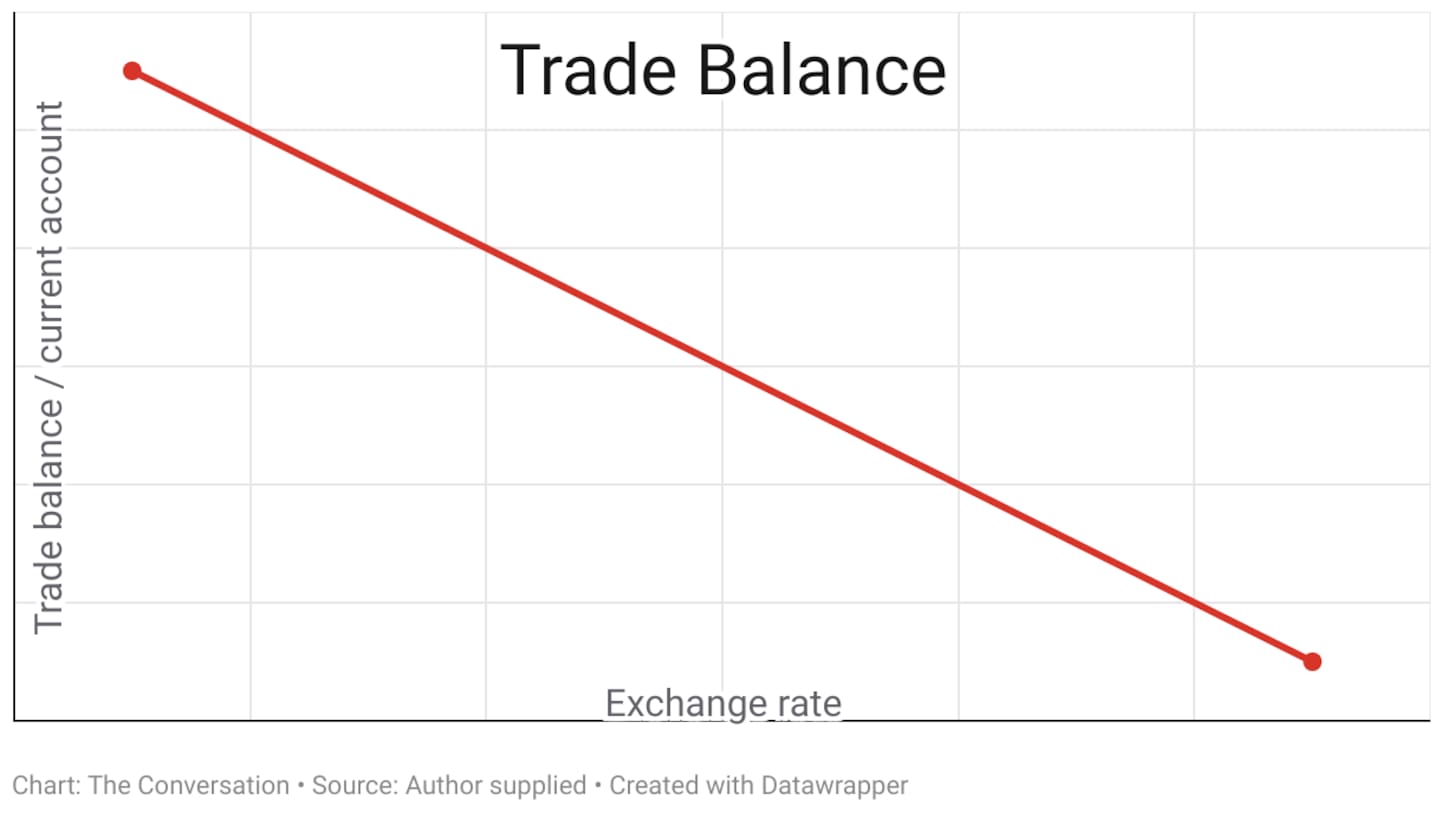

Third comes the trade balance – the current account of the balance of payments (investment income and traded goods and services between New Zealand and the rest of the world).

第三是贸易差额——国际收支(新西兰与世界其他地区之间的投资收入和贸易商品和服务)的经常账户。

If everything else stays the same here, as the exchange rate of the dollar falls, the current account strengthens by moving towards or expanding a surplus. If the exchange rate rises, the current account weakens: exports fall and imports increase.

如果这里的其他一切都保持不变,那么随着美元汇率的下跌,经常账户会通过走向或扩大盈余而走强。如果汇率上升,经常账户就会走弱:出口下降,进口增加。

However, it’s a mistake to suppose each of these relationships will stay where it is while the government and Reserve Bank each tinker with their own policy settings. So, what could go wrong?

然而,如果认为这些关系中的每一个都会保持原样,而政府和储备银行各自修改自己的政策设置,那就大错特错了。那么,会出什么问题呢?

[xyz-ihs snippet=”googleAD300x100″]

The effect of austerity 紧缩的影响

Start with the IS curve – the way output and employment are affected by interest rates, assuming the government makes no big budgetary changes. But what if the government embarks on an austerity programme, slashing its spending and cancelling projects, which shrinks the economy?

从 IS 曲线开始——假设政府没有进行重大预算调整,产出和就业受利率影响的方式。但是,如果政府开始实施紧缩计划,削减支出并取消项目,从而导致经济萎缩,情况会怎样?

At any given interest rate, output and employment will be lower, shifting the whole curve “leftwards” towards lower economic activity (see above).

在任何给定的利率下,产出和就业都会更低,使整个曲线“向左”移动,导致经济活动下降(见上文)。

Even if the Reserve Bank lowers the interest rate, that won’t expand the economy because the government’s fiscal policy is killing off its expansionary effect. The recession created by the austerity programme rolls on.

即使储备银行降低利率,也不会扩大经济,因为政府的财政政策正在扼杀其扩张效应。紧缩计划造成的衰退仍在继续。

Along the way, it increases costs to government from unemployment, paying other benefits, and lower tax revenue. If the government responds with further austerity, we enter a downward self-reinforcing spiral.

在此过程中,它增加了政府因失业、支付其他福利和减少税收而付出的成本。如果政府以进一步的紧缩政策作为回应,我们将进入一个向下的自我强化螺旋。

[xyz-ihs snippet=”GoogleADresponsive”]

Wages and inflation 工资和通货膨胀

Secondly, take the Phillips curve and ask what happens if inflation isn’t, in fact, sensitive to how the economy is doing.

其次,以菲利普斯曲线为例,询问如果通胀实际上对经济状况不敏感会发生什么。

In this case, driving the economy into recession has no effect on the inflation rate. When the Reserve Bank changes the interest rate, inflation just stays where it is because the Phillips curve is flat, not upward-sloping. Reducing inflation requires completely different policy interventions.

在这种情况下,将经济推入衰退对通货膨胀率没有影响。当储备银行改变利率时,通货膨胀率会保持在原位,因为菲利普斯曲线是平坦的,而不是向上倾斜的。降低通货膨胀需要完全不同的政策干预。

Back when the Phillips curve was invented, it was reasonable to think inflation fell during recessions because workers could get higher wage increases in booms than in slumps.

早在菲利普斯曲线发明时,人们有理由认为通货膨胀率在经济衰退期间下降,因为工人在经济繁荣时期的工资增长可能比在经济衰退时期获得更高的工资增长。

Bringing on a recession would reduce the bargaining power of workers, result in slower wage growth, and thereby tame inflation (given that wages are an important part of the costs of production).

引发经济衰退会降低工人的议价能力,导致工资增长放缓,从而抑制通货膨胀(鉴于工资是生产成本的重要组成部分)。

But workers today have lost the bargaining power they used to have when unions were strong and welfare-state thinking prevailed.

但今天的工人已经失去了他们过去在工会强大和福利国家思想盛行时所拥有的讨价还价能力。

In a paper fellow economist Bill Rosenberg and I published this year, we show that the bargaining power of labour was killed off in 1991 by the Employment Contracts Act and has not recovered since. Wages no longer drive inflation in contemporary New Zealand.

在我和经济学家比尔·罗森伯格(Bill Rosenberg)今年发表的一篇论文中,我们表明,劳动者的议价能力在1991年被《雇佣合同法》扼杀了,此后就再也没有恢复过来。工资不再推动当代新西兰的通货膨胀。

Interest rates and inflation

利率和通货膨胀

Could the Phillips curve work because producers of goods and services push up prices and profits faster in booms and cut their margins in recessions?

菲利普斯曲线能否奏效,因为商品和服务的生产商在繁荣时期更快地推高价格和利润,而在经济衰退时削减利润率?

It’s possible: there’s plenty of evidence of big companies using their market power to price-gouge consumers. But it’s not clear this exercise of market power is greater in booms and lesser in slumps.

这是可能的:有大量证据表明,大公司正在利用他们的市场力量来哄抬消费者的价格。但目前尚不清楚这种市场力量的行使在繁荣时期更大,在低迷时期较小。

In fact, the opposite could be true. Small businesses are most likely to be driven out of the market in recessions, leaving big companies with increased market share and less competitive pressure on their margins.

事实上,情况可能恰恰相反。小企业最有可能在经济衰退中被赶出市场,使大公司的市场份额增加,利润率的竞争压力较小。

Forces both locally and in international markets have clearly been pushing the Phillips curve down, producing lower inflation.

本地和国际市场的力量显然一直在推动菲利普斯曲线下降,从而降低了通胀。

Local forces include the current Government’s abrupt cancellation of major construction activities, dismissal of public servants, the constant negative messaging on the state of the economy, and rising outward migration as a consequence of all these.

地方力量包括现任政府突然取消重大建筑活动、解雇公务员、不断传递关于经济状况的负面信息,以及所有这些导致的向外移民增加。

International markets, including falling prices for imports such as oil, have also clearly been pushing the Phillips curve down. While the Reserve Bank will claim credit, it’s not at all clear the bank’s interest rate policy has made that much difference.

国际市场,包括石油等进口价格的下跌,显然也在推动菲利普斯曲线下降。虽然储备银行会申请信贷,但目前尚不清楚该银行的利率政策是否产生了如此大的影响。

Finally, what about the international balance of payments? One thing the Reserve Bank can do by changing the interest rate is change the exchange rate between the New Zealand dollar and other currencies.

最后,国际收支呢?储备银行可以通过改变利率做的一件事是改变新西兰元与其他货币之间的汇率。

If New Zealand’s interest rates increase relative to elsewhere in the world, short-term money flows in to take advantage of the higher rates.

如果新西兰的利率相对于世界其他地区上升,短期资金就会流入以利用更高的利率。

This raises the exchange rate, and in turn weakens the external balance by cutting the return on exports and increasing the volume of cheaper imports.

这提高了汇率,进而通过削减出口回报率和增加更便宜的进口商品的数量来削弱外部平衡。

Producers of goods and services that face international competition are squeezed. Meanwhile, what used to be called the “sheltered” or “non-tradeable” industries – including the big banks, insurance companies, electricity suppliers, supermarkets, consultancies – are unscathed.

面临国际竞争的商品和服务生产商受到挤压。与此同时,过去所谓的“庇护”或“非贸易”行业——包括大银行、保险公司、电力供应商、超市、咨询公司——也毫发无损。

Deeper recession 更深的衰退

The Reserve Bank may not have much effect on inflation, but it can certainly affect the structure of the economy.

储备银行可能对通货膨胀没有太大影响,但它肯定会影响经济结构。

Using the interest rate as the weapon against inflation squeezes manufacturers, tourism and farmers, but leaves non-tradeables largely untouched.

利用利率作为对抗通货膨胀的武器会挤压制造商、旅游业和农民,但非贸易物基本上不会受到影响。

Right now in New Zealand, the IS curve is remorselessly shifting left as the economy plunges into a deeper recession exacerbated by Government austerity – an ideologically driven quest for instant fiscal surpluses, low public debt, and a shrinking public sector relative to GDP.

目前在新西兰,随着经济陷入更深的衰退,政府的紧缩政策加剧了这种衰退——意识形态驱动的对即时财政盈余、低公共债务和公共部门相对于 GDP 的萎缩,IS 曲线正在无情地向左移动。

Falling interest rates will struggle to make expansionary headway against that austerity.

不断下降的利率将难以在这种紧缩政策中取得扩张性进展。

Corporate profiteering and rising government charges continue to put upward pressure on the Phillips curve, and the balance of payments is weakening.

企业暴利和不断上涨的政府费用继续给菲利普斯曲线带来上行压力,国际收支正在减弱。

This means the country as a whole is piling up increasing debts to the rest of the world (largely through the Australian-owned banks).

这意味着整个国家正在积累对世界其他地区的不断增加的债务(主要通过澳大利亚拥有的银行)。

The question is, does the Government understand where its policies are taking us?

问题是,政府是否了解其政策将我们带向何方?

来源:NZ Herald

[xyz-ihs snippet=”moreNZnews”]

[xyz-ihs snippet=”multiple-ads”]

705 views